02

Context

World market today. Regulation affecting emissions from maritime transport. Alternative fuels.

03

PositioningHIVE2

LNG as a gateway to renewable gases. Bases of the strategy. Formulation. Objectives and tools

04

Competitive analysis

Competitive situation of the Spanish gas infrastructures in the international context.

05

Action plan

Investment Plan

Possible lines of action.

Investment plan based on an internal study of the demand Hive2.

INTRODUCTION

After the publication in October 2014 of Directive 2014/94 of the European Parliament and Council lMember states individually addressed the deployment of supply infrastructuresro and the development of the market for alternative fuels for transportation.

In compliance with the Directive, each member state developed its National Action Framework (MAN) promoted by an Interministerial Group. According to the last monitoring report of the MAN[1], the objectives established for the maritime sector have been largely achieved, since the main objective in this area was the deployment of LNG supply points for maritime consumption in all the Spanish ports of the main European transport network before the year 2025. Today it is feasible to supply ships, in the tanker mode -TTS and MTTS- in practically the entire Spanish port system and in its STS mode on the Mediterranean façade. Among other initiatives, the CORE LNGas Hive project stands out for its scope, budget and public-private collaboration, which has decisively contributed to the objectives of the MAN.

In December 2019 the president of the European Commission presented the Green Pact of the European Union, a plan that accelerates the European commitment towards sustainability and includes fifty specific actions to fight climate change, aspiring to make Europe the first climate-neutral continent in the year 2050. This initiative addresses a review plan of all the recommendations and regulations that affect climate change, tackling - with greater ambition than until now - transport emissions

maritime, having started among others: revision of the Alternative Fuels Directive, a new directive on the market of marine fuels, MRV Directive, the regulation of fuel taxes, etc.

Traditionally, Europe has promoted maritime transport policies from the IMO because it is a globalized sector. Although the IMO has on its agenda to incorporate the sector within the framework of the Paris Agreements, with important decisions planned for the year 2023, Europe could address from its scope some measures that exceed the

IMO agenda.

[1] Report on the application of the National Action Framework for Alternative Energies in Transportation December2019

In this context, and to avoid debates on regulatory uncertainties, which prolong the current state called "wait and see" in which we find ourselves, we can establish some premises that, being valid today, will also be valid in the future, allowing us to frame the formulation of the HIVE2 positioning:

- The decarbonisation of maritime transport must begin now.

- The chosen solutions must allow significant levels of decarbonisation in the useful life of the ship 25-30 years. This is a ship built in 2025 should have the ability to fully reduce its emissions by 2050.

- Shipowners / investors betting on new alternatives expect their decisions to be safe, competitive and profitable.

- The decarbonisation objective of the maritime sector is framed within a global objective, but maritime transport accounts for only 3% of global CO2 emissions, so the solution will largely depend on the developments achieved in the land area.

Goals

It is from this context that a proposal for the deployment of LNG for maritime transport in Spain with a 2030 horizon, called HIVE2 positioning. This exercise is an opportunity to review the role of LNG as a viable transition technology towards decarbonization. This agreed positioning will make it possible to influence the future regulatory development of alternative fuels, as well as to guide the gas sector in mobility towards a path of obligatory decarbonisation.

The HIVE2 positioning proposes to promote the adoption of renewable gases in maritime transport, supporting the deployment of infrastructures, consumer vessels and the LNG service industry in Spain.

INTERNATIONAL CONTEXT

Until the entry into force of the IMO 2020 regulations, the global bunkering market - with a size of approximately 210 Mt - was dominated by the consumption of fuel oils (HFO) with a market share close to 85%. With the new regulations, this distribution has been considerably modified, increasing the importance of diesel (MGO/MDO) in the mix - from 15 % to approximately 25 % - and a new fuel has emerged, 0'5% S fuel oil ( called VLSFO Very Low Sulfur Fuel Oil) whose consumption is approximately 50%, as reflected by the data provided by two of the main bunkering ports globally, Singapore and Rotterdam. The main bunkering supply region is Asia, with 35 % of total fuel sales, followed by Europe with 20 % - between 50 and 53 Mt approx. - and in relation to the supply ports there is a great concentration of services in two areas, Singapore and ARA zone.

NATIONAL CONTEXT

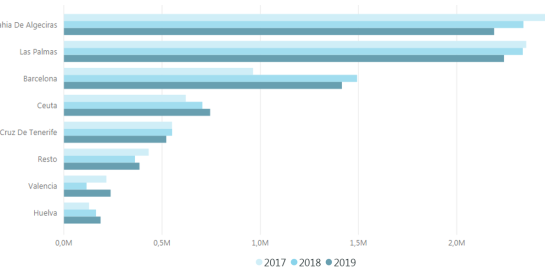

In the Spanish market there are two large bunkering market niches: large ports with large freight traffic and a high number of calls that compete with the rest of the ports on the line and ports located in large maritime corridors, Using their anchorage areas, they allow ships to climb to carry out supply tasks exclusively, which compete on a global level with the rest of the ports located in the large corridors. An example of the first case would be the port of Barcelona, which without supplying at anchor, is the third port due to supply to container ships, while an example of the second case would be Ceuta, a port with ship traffic and a transfer of goods. very small, but due to its location and offer of services it holds fourth position in the ranking. The two leading ports - Algeciras and Las Palmas - stand out enormously above the rest precisely because of the presence of the two types of markets.

DECARBONIZATION ALTERNATIVES FOR MARITIME TRANSPORT

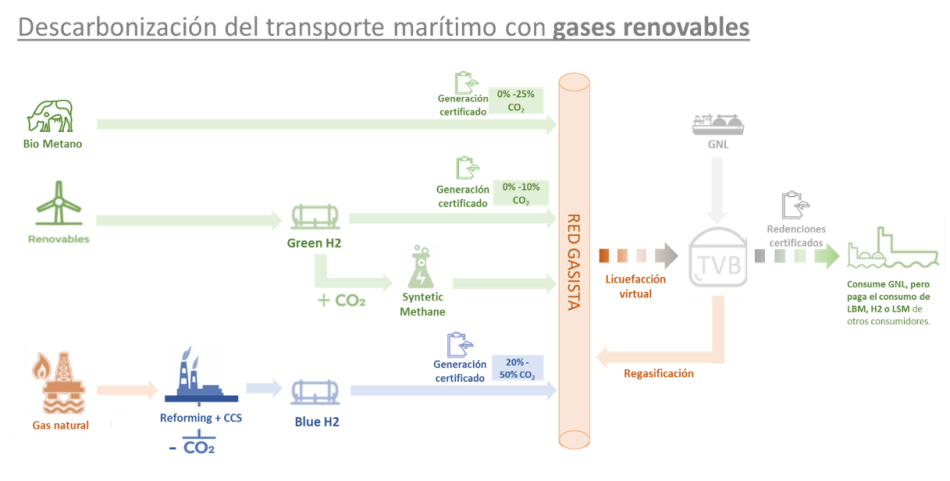

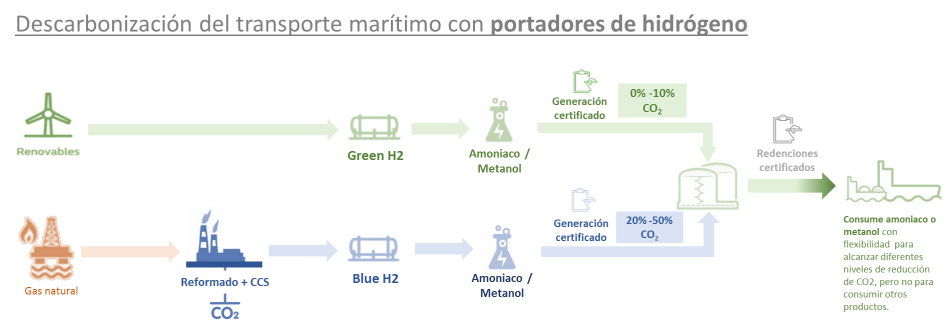

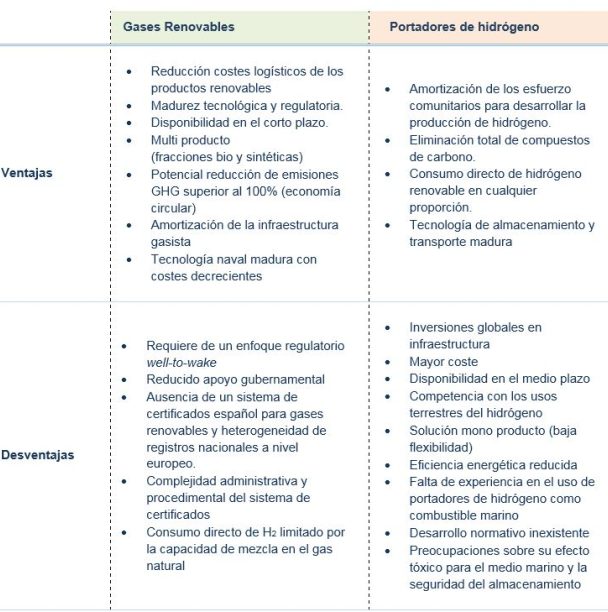

Considering the energy sources available for maritime transport, two alternatives seem to stand out from the rest:

- The use of LNG and renewable gases, of bio or synthetic origin in different proportions

- The use of liquid hydrogen carriers, such as ammonia or methanol

HIVE2 positioning for the adoption of

renewable gases as fuel in maritime transport

The HIVE2 proposal proposes to promote the adoption of renewable gases - both biomethane and hydrogen - in maritime transport by supporting the deployment of infrastructure, consumer ships and the LNG service industry - capable of consuming these renewable gases - with three main objectives:

- Decontaminate and decarbonise maritime transport and the port sector in the short term - more than 10,000 ships will be built between 2020 and 2030 - and favor the integration of renewable gases in the energy mix in the medium and long term, both in the shipping sector and in the port sector.

- Increase the competitiveness of the maritime and port sector reducing its operating costs, and reducing the risk of obsolescence of investments, as a result of future regulations on atmospheric emissions.

- Promote the industrial and social growth of Spain with the development of specialized services with high added value aimed at the LNG sector.

SPAIN IS THE EU COUNTRY WITH THE GREATEST LNG STORAGE CAPACITY AND ONE OF THE MOST ADVANCED REGULATIONS

It holds 25% of European LNG storage capacity, with terminals in both the Atlantic and Mediterranean corridors.

All terminals are publicly accessible, unlike many of the Northern European and Mediterranean terminals.

The storage capacity is managed jointly (Virtual Balance Tank) and the virtual liquefaction service allows the exchange of natural gas in the gas pipeline for LNG in the storage terminal if an operator has both.

SPAIN HAS THE NECESSARY INFRASTRUCTURE TO SUPPLY LNG TANKS AND BUNKERING VESSELS

The Spanish offer of LNG storage terminals and logistics services in the different maritime corridors is the largest on the European continent, especially in the Mediterranean Sea, where most of the LNG import terminals do not have a tanker loading service. or ships.

THE USE OF LNG AS FUEL WOULD GENERATE A SIGNIFICANT REDUCTION IN COSTS FOR SHIPPERS

Taking as a reference the average price calculated for bunkering logistics (€5/MWh) and the price of marine fuels in Spanish ports from 2018 to mid-2020, there is an average differential of approximately €12/MWh between LNG and conventional FOB fuel, which represents a reduction of more than 25 % in the price of fuel and would save more than €3 million per year on a ship with an average consumption of 25,000 t of conventional fuel. In addition, the trend indicates a widening of the differential between fuels, which during 2020 has averaged €15/MWh despite the collapse of the price of oil -and derived marine fuels-.

The LNG cost simulation tool allows calculating the savings in operating expenses and emissions using LNG-powered ships

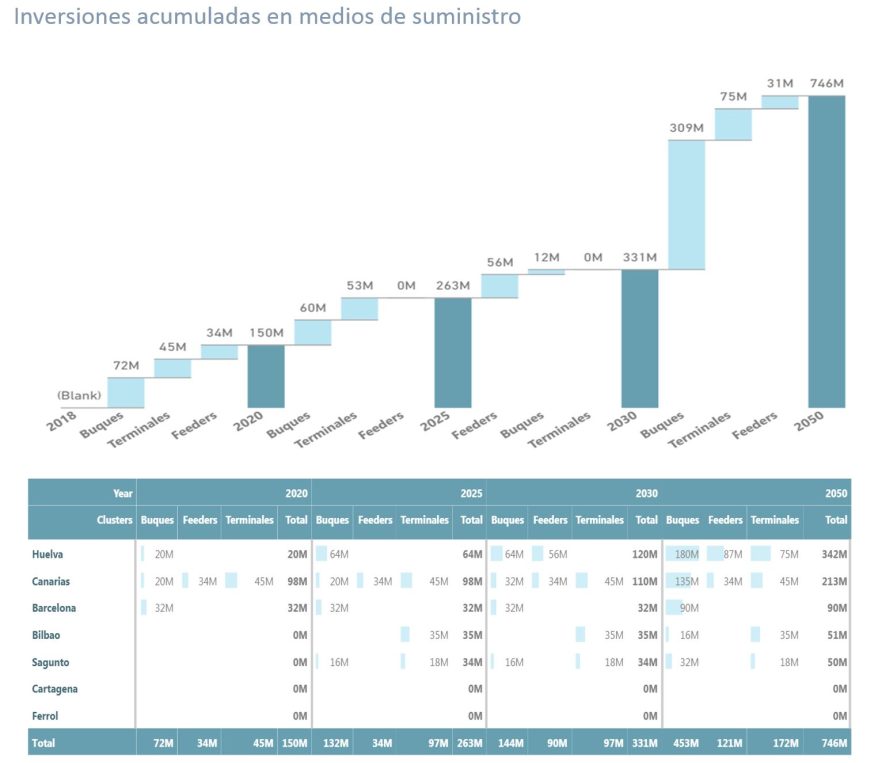

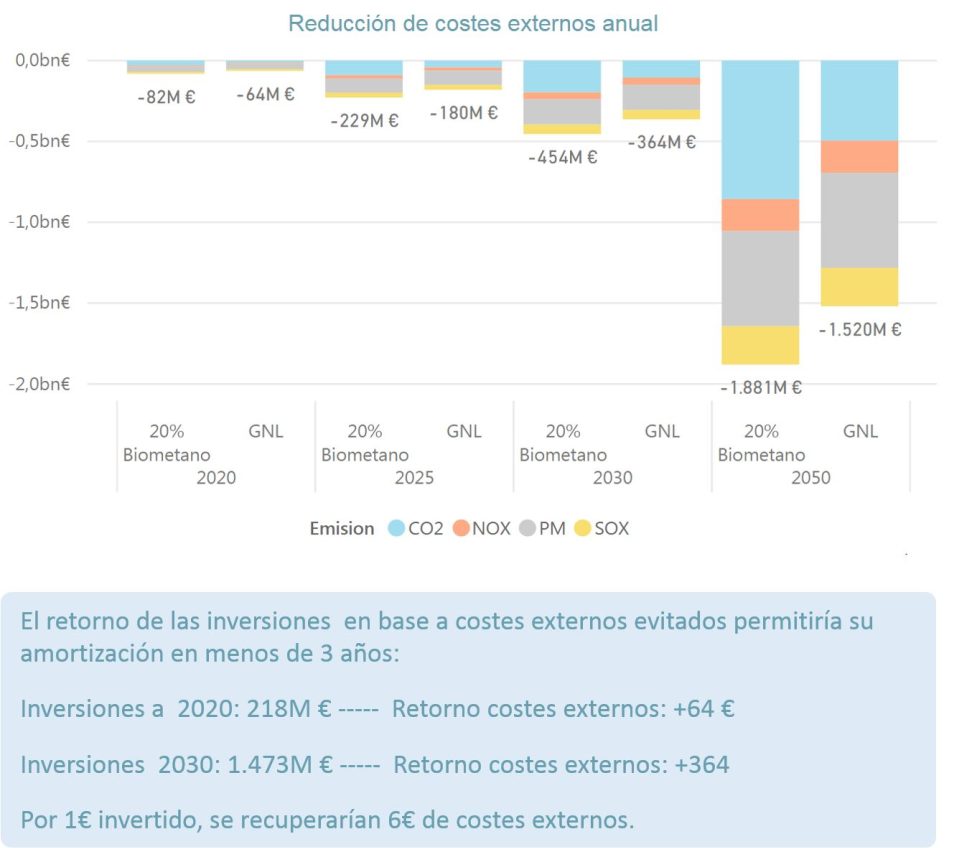

DEMAND ESTIMATION AND INVESTMENT PLAN

Together with the preparation of the HIVE2 proposal, the HIVE consortium has made an estimate of the demand for LNG expected in Spanish ports, as well as the investments required to start up the required supply infrastructure. In addition, based on the references provided by the report Thinkstep GHG emissions of LNG as marine fuel The external costs that would be avoided with the consumption of the estimated demand are estimated.

ACTION PLAN

Achieving the objectives set out in the HIVE2 proposal will require an action plan that addresses the identified weaknesses and enables potential threats to be addressed, while maintaining the strengths displayed and exploiting possible opportunities. The main lines of action identified by the HIVE2 proposal are the following:

In the area of financing:

- Promote aid for joint development projects (product - infrastructure-consumption).

- Provide pioneering initiatives in the incorporation of renewable gases with the support of the Spanish administration for the financing of their projects.

- Promote the search for financing in coordination and / or collaboration with the electricity system.

- Develop and / or promote a fuel taxation that recognizes the environmental footprint of marine fuels.

- Incorporate a differentiated favorable treatment of vessels that consume alternative fuels in the RECA (Canary Islands Special Registry).

- Promote the development of an offer of added value services aimed at the cryogenic sector and renewable gases. Communication and technical certifications. Aid PYMAR…

In the field of communication:

- Promote a common approach in the Spanish administration, based on technological neutrality and the assessment of well-to-wake emissions, which serves as a reference before international organizations that affect maritime transport.

- Establish joint initiatives between the gas and port systems for the international promotion of the availability of LNG and renewable gases as marine fuel, as well as their competitiveness at an economic and environmental level.

- Establish joint initiatives with international Port Authorities to promote the availability of LNG and renewable gases along the major maritime traffic corridors.

In the field of regulation:

- Promote a certification system and guarantees of origin for renewable gases at the national level, which makes it possible to take advantage of the virtual liquefaction and balance tank services of the gas system to distribute renewable LNG in Spanish ports.

- Specifications and implementation guides coordinated between Port Authorities and aligned with the best international practices.