A new star has returned to the climate scene: hydrogen. Offers possibilities to move away from fossil fuels, but brings its own challenges

The Commission's net zero emissions scenarios for 2050. In theory, you can do three things: store surplus renewable energy when the grid cannot absorb it, help decarbonize hard-to-electrify sectors such as long-distance transportation and industry heavy, and substitute fossil fuels as a zero carbon feedstock in the production of chemicals and fuels.

Hydrogen was originally used by the Nazis to produce synthetic fuels from coal. Nowadays, it is back in fashion. The International Energy Agency praised its "vast potential" in a first-ever report on hydrogen in June 2019. Bloomberg New Energy Finance said clean hydrogen "can help address the toughest third of global greenhouse gas emissions." greenhouse by 2050" in March 2020.

"Europe is the laboratory. We see it as the place where technology and, above all, politics can be put to the test and pave the way for global implementation."

Emmanouil Kakaras, Head of New Business at Mitsubishi Power Europe

The hydrogen economy is one of the priorities of the EU's economic recovery package after the 19-year crisis; This package is governed by the European Green Deal, which commits Europe to becoming the first climate-neutral continent by 2050. It is difficult to overstate the difference from Europe's previous target, an emissions reduction of 80-95% by 2050. Neutrality requires the total elimination of fossil fuels. This makes the

"If Europe adopts a 55% emissions reduction target for 2030, Germany would have to cut its heating emissions by half. That is impossible with realistic renewal rates and with electricity alone. Gas for heating will have to be decarbonized."

Eva Hennig, Head of EU Energy Policy

Hydrogen is a lifeline for regions like the north of the Netherlands, with expertise and infrastructure seeking a new purpose as earthquakes and climate change turn natural gas from a blessing to a bane.

However, the climate community is cautious.

"The risk is that the [hydrogen] hype will cause a reversal of priorities. Energy efficiency, renewable energy and direct electrification are the main solutions [to climate change]. Hydrogen is situated around them. Hydrogen "It is essential to reach neutrality in certain sectors such as industry, but we are talking about the last 20% of emissions reduction."

Dries Acke, Director of the Energy Program at the European Climate Foundation,

Furthermore, the climate impact of hydrogen depends entirely on how it is manufactured. "There is a risk that policies will take precedence over definitions," Acke continues. It warns that this could see hydrogen go the way of biofuels, which have suffered from start-stop policies due to intense debate over their net impact on climate change. "Hydrogen is not a technology, but an energy vector that can be produced in a clean or dirty way," he says.

Today we talk about three main types of hydrogen. First of all, "gray" hydrogen. Most of the hydrogen used - and there is a lot of it, especially in industry - is made from natural gas. The process emits CO2. Second, “blue” hydrogen, or as the gas industry likes to call it, “decarbonized,” is made from natural gas with carbon capture and storage (CCS) (see Box 1). Finally, "green" or "renewable" hydrogen - which all hydrogen advocates say is the ultimate goal - is made from the electrolysis of water powered by renewable energy.

There are other colors. The main one on the horizon is "turquoise" hydrogen obtained by pyrolysis of molten metals. It involves the thermal cracking of natural gas into hydrogen and solid carbon. Its appeal is twofold: on the one hand, it does not require CCS, and on the other, instead of CO2 it produces a material that has been on the EU's list of critical raw materials for years (such as "natural graphite"). Large companies such as the Russian Gazprom and the German BASF are studying it, but it is a technology that is still in its infancy.

How to make the business work

For some, like Samuele Furfari, professor of energy geopolitics at the Université Libre de Bruxelles (Belgium), hydrogen of any color makes little sense. It makes much more sense to directly use fossil fuels or electricity. "Every [conversion] step is a waste of energy," he says. "The processes are technically viable, but they are nonsense from an energy and economic point of view. Hydrogen has re-emerged because we need a solution to the intermittency of renewables."

Ad van Wijk, professor of future energy systems at the Delft University of Technology (Netherlands) and founding father of the hydrogen economy concept, replies that efficiency is no longer the benchmark: "A solar panel in the Sahara generates 2- 3 times more energy than one in Holland. If you convert that energy into hydrogen, transport it here and convert it back into energy using a fuel cell, you are left with more energy than if you installed that solar panel on a Dutch roof. In a sustainable energy system, is calculated in terms of system costs, not efficiency".

summarizes van Wijk: "even if all production and consumption were electric, more than half of that energy would have to be converted into hydrogen for [cost-effective] transport and storage." Electrical cables can carry up to 1-2 GW, but the average gas pipeline can carry 20 GW (and is 10-20 times cheaper to build). The challenge is to convert existing pipelines from natural gas to hydrogen, says van Wijk.

However, clean hydrogen faces a paradox in its business case. The potential volumes are in industry, while the potential profit margins are in transportation. Energy-intensive industries are the largest consumers of hydrogen today. As Europe aims for climate neutrality by 2050, there is growing interest in clean hydrogen in sectors such as steel and chemicals (more than half of all hydrogen in the world is used in fertilizer production and oil refining ). However, these are extremely price-sensitive industries and exposed to global competition. Companies are not willing to pay several times the "grey" price for a climate-friendly alternative.

"Heavy industry is pushing to introduce green hydrogen into road transport, so that private vehicle owners will bear some of the early costs. But we believe it will be a scarce resource and it makes more sense to grow demand in sectors such as heavy industry, where there is no decarbonization alternative".

Hilipp Niessen, Director of Industry and Innovation at the ECF.

"There is a push for political compromise around steel," adds Niessen. The European steel industry suffers from aging assets, overcapacity and Chinese competition. "Public support for clean steel could help European industry rebuild its assets, first to run on gas and, from the mid-2030s, on clean hydrogen." Until now, steel production continues to be based on coal.

Few believe that private cars will run on hydrogen in the future. They are expected to be electric. Instead, trucks are the battlefield. Truck manufacturers such as Volvo and Daimler and logistics giants such as Deutsche Post DHL and Schenker stated at a conference in Brussels in February 2020 that, for them, the future of freight transport is electric and, in the case of long, electric plus hydrogen. The advantage of electric trucks is that they are already available today, they said. By contrast, oil and gas suppliers argue that the way forward is "low-carbon liquid fuels", meaning, increasingly, synthetic fuels or "e-fuels" made from renewable hydrogen.

In practice, the Commission is studying the possibility of ordering EU Member States to deploy an infrastructure for electric charging for trucks and sustainable fuel blending quotas in aviation and maritime transport. Stakeholders agree that e-fuels are essential to decarbonize aircraft and ships in the long term. Along with heavy industry, emissions from these two sectors are the most difficult and costly to reduce.

Blue hydrogen: a controversial rung

Blue hydrogen revives the history of capture and storage (CCS). This is the production of "decarbonized" hydrogen by applying CCS to the traditional hydrogen manufacturing route through steam methane reforming. The European Commission calls CCS a "priority innovative technology" in its "Green Deal" and promises it new funds in its COVID-19 recovery package.

The big difference from the past - Europe's policy makers have already invested billions in this technology, with little to show - is the new narrative of the hydrogen economy, a shift in focus from the energy sector to industry, and projects. They start from the perspective of transportation and storage rather than carbon sequestration. The concept has moved from post-combustion CCS to pre-combustion. This means that the business case no longer depends entirely on the EU carbon price - never high enough - but also on the value of the blue hydrogen it produces.

path towards clean fuels by taking advantage of its current gas production, transportation and storage facilities. “What we are risking [with CCS] is rapid decarbonization of gas,” joked Per Sandberg of Norwegian oil and gas giant Equinor at an event on CCS held at the European Parliament in Brussels in January 2020.

Many argue that blue hydrogen is essential to creating a market for what will eventually become green hydrogen. However, the climate community is divided. From a climate point of view, the problem with blue hydrogen is that it depends on CCS and natural gas. First, commercially viable CCS remains an aspiration rather than a reality, and second, carbon capture can never be 100% efficient. At the same time, there is great uncertainty about the climatic impact of methane leaks in the initial phases.

Methane is the most important short-lived climate pollutant. Methane emissions in 2020 will cause half of global warming in the next 20 years, according to the US NGO Environmental Defense Fund. The oil and gas industry is the second largest source of methane emissions after agriculture and the easiest to tackle. The International Energy Agency estimates that 40% of industry emissions could be avoided at no net cost.

The EU is working on a methane strategy. Reducing methane emissions could play a "very important role" in being able to raise its 2030 climate ambitions, an EU official said in November 2019. "The credibility of the gas is at stake," said Mónika Zsigri of the Department of Energy Commission. "The methane leak determines how interesting gas is compared to the direct jump to renewables." It also determines how interesting blue hydrogen is versus green.Show more of this chart

Depends on politics

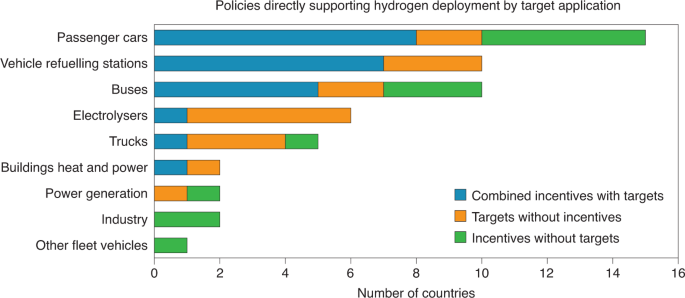

The emergence of a clean hydrogen economy depends on regulation (see Figure 1). "The biggest challenge is getting the policies right," says van Wijk. "We have to create a hydrogen infrastructure. It is a huge task that needs political support." The first European hydrogen strategy, published in July 2020, aims to support the broader goal of "sector integration". Initially, this meant using carbon-free energy to help decarbonise other sectors, such as transport and industry. But it has become a broader bid to delineate the roles of electricity and "molecules" in the future energy system.

The new EU industrial strategy of March 2020 considers the decarbonisation of industry to be an "absolute priority". “The industry has some of the longest-lived assets,” explains Matthias Deutsch, senior associate and hydrogen expert at Agora Energiewende, a German think tank dedicated to the energy transition. "Production plants can operate for 30-40 years. That means there will be investments in this decade that will determine the climate footprint of industries in 2050. We have to give them a long-term perspective."

There is another industrial dimension: Europe is the world leader in electrolysis technology. In the last 10-15 years it has filed twice as many patents and publications as its closest competitors - the United States, China and Japan. "Electrolyzers will become one of those critical technologies like solar, wind and batteries," Acke says. "Europe has a competitive advantage and can maintain it." However, there are those who already warn of strong competition from China.

The green hydrogen economy needs tailored support. "EU policy is trying to repeat the success of renewable energy," says Kakaras. "But there is a big difference: unlike solar and wind, green hydrogen production is governed by operating expenses, not capital expenses. The 80% of the cost depends on the price of electricity." Subsidies to promote large-scale deployment could reduce the cost of electrolyzers, but this will not necessarily make green hydrogen production cheaper.

Kakaras explains: "You need an electricity price high enough for renewable energy to be viable and low enough for hydrogen produced from it to be competitive with gas." In practice, it is not possible to do both, he adds. "Policymakers have to bridge the gap between the price of carbon-free fuel and the price of gas." In practice, stakeholders are converging on the idea of Contracts for Difference for green hydrogen.

Eurogas, which represents the European gas industry, wants policy makers to set targets for renewable and decarbonised gas and let the market decide what works best for various end uses. Other stakeholders, such as Agora Energiewende and ECF, believe that support for hydrogen should reflect the need to prioritize specific sectors. After all, it must remain a complement to energy efficiency, renewable energy and direct electrification.

One of the most controversial issues is the use of hydrogen in residential heating. According to Hennig, "even if you only mix 20% of hydrogen - and reduce CO2 by only 6.5% as a result - it is better than nothing. Especially if it is possible without adapting the end user's devices." It argues that hydrogen blending into gas networks is essential to help increase clean hydrogen production and its transport. Climate advocates respond that homes should instead switch to more efficient heat pumps and district heating. Extending hydrogen to heating poses the risk of "oversizing" the European energy infrastructure.

Renewable energies change the rules of the game

The biggest challenge with green hydrogen is that it will require large amounts of renewable energy. The IEA estimates that 3,600 TWh per year would be needed to meet the current demand for hydrogen by electrolysis of water, that is, more than the entire annual electricity production of the EU2. Imagine that its use is expanded from industrial raw material to energy carrier in industry, transportation, heating and electricity production.

Stakeholders agree that Europe will never be able to produce enough renewable energy to run a self-sufficient hydrogen economy. The Commission assumes that there is scope for 1,000 GW of offshore wind in the North Sea, half of which is dedicated to electrolysis1. But a study by Agora Energiewende also warns that the number of planned offshore wind turbines in the German section of the North Sea after 2030 risks reducing their full load hours from 4,000-5,000 to just 3,000.

From another perspective, hydrogen is increasingly seen as a way to bring wind power to shore and relieve pressure on an already overstretched onshore grid. Some companies are studying the possibility of building electrolyzers directly into the body of wind turbines. Green hydrogen gives renewables a business case when the electricity system alone cannot. "Conversion to hydrogen is a kind of hedge for the renewable energy investor," says Kakaras.

In reality, the hydrogen economy is an international project. Cross-border cooperation can ensure that North Sea wind farms have enough space. Scale and economics dictate that Europe will likely import green hydrogen from North Africa and the Middle East, and e-fuels from as far away as Australia and Chile.

One of the biggest questions is whether green hydrogen can be ready quickly enough to make a difference in climate change. Niessen says: "We live with limited carbon budgets. Electrolysers are not microchips. Of course, costs will come down significantly, but will they come down fast enough to meet the Paris climate goals?"

Many believe that blue hydrogen – with proper climate safeguards – has a transitional role. It could help launch different sectoral uses and reduce prices through economies of scale. "Blue hydrogen could help accelerate industrial transformation," says Deutsch. "The concern is that if a lot of this low-carbon hydrogen becomes available, it may not be limited to the sectors that really need it." Currently, gray hydrogen costs around 1.50 euros per kg-1, blue between 2 and 3 euros per kg-1 and green between 3.50 and 6 euros per kg-1. Consultants estimate that a price of 50-60 euros per ton of carbon could make blue hydrogen competitive in Europe10.

"In my opinion, we got the system moving," says van Wijk. "As demand for hydrogen grows and green hydrogen becomes cheaper, it will complement and replace this fossil-based hydrogen." Japan, which invested in hydrogen long before climate neutrality was on the agenda, is working with its main supplier, Australia, to transition from gray to blue to green. "Green hydrogen will end up being cheaper than gray hydrogen, because wind and solar energy is very cheap," says van Wijk. "That's the game changer."

"If deep decarbonization is on society's agenda, hydrogen will come," Kakaras believes. It is not about the laws of thermodynamics, but about whether society is willing to pay for climate neutrality. Michael Moore's documentary Planet of the Human suggests that "less is more" is the only long-term response to climate change. But the COVID-19 shutdowns showed how big this ask is: emissions were slashed but did little for climate change.”

However, there is an opportunity. As Furfari says: "The Green Deal was an opportunity for politicians to spend public money. The COVID-19 crisis gives them license to spend whatever they want."

References:

- A Clean Planet for all: A European Long-term Strategic Vision for a Prosperous, Modern, Competitive and Climate Neutral Economy (European Commission, 2018).

- The Future of Hydrogen (IEA, 2019).

- Hydrogen Economy Outlook: Key Messages (Bloomberg LP, 2020).

- Europe's moment: repair and prepare for the next generation. European Commission https://bit.ly/31vlPNz (2020).

- A European Green Deal. European Commission https://bit.ly/3fCJIYL (2020).

- A Hydrogen Strategy for a Climate-neutral Europe (European Commission, 2020).

- Biebuyck, B. FCH-JU making hydrogen and fuel cells an everyday reality. Fuel Cells and Hydrogen Joint Undertaking https://bit.ly/3kgTJOE (2019).

- Towards Fossil-Free Energy In 2050 (European Climate Foundation, 2019).

- Making the Most of Offshore Winds: Re-evaluating the Potential of Offshore Wind in the German North Sea (Agora Energiewende, Agora Verkehrswende, Technical University of Denmark and Max-Planck-Institute for Biogeochemistry, 2020).

- Peters, D. et al. Gas Decarbonisation Pathways 2020–2050: Gas for Climate (Guidehouse, 2020).

- Le Quéré, C. et al. Nat. Clim. Change 10, 647–653 (2020).Article Google Scholar

- Methane Tracker 2020 (IEA, 2020).