Competitiveness

of alternative fuel supply services and ground connection in Spanish ports.

The use of alternative fuels with carbon-neutral emissions is the measure with the greatest potential for the decarbonisation of maritime transport, although it is also the one with which shipping companies face a greater degree of uncertainty, since there is still no industrial-scale production for many of them. solutions, consumption equipment on board or a regulation, neither market nor technical, at an international level.

Taking into account the reference studies on the development of new fuels and propulsion systems and taking into consideration the objectives of the IMO and the EU, various energy alternatives could be proposed for the decarbonization of maritime transport, which are analyzed with a focus on those considered greater relevance, as well as in the current situation of Spain and its main competitors in the different maritime transport corridors, which it occupies.

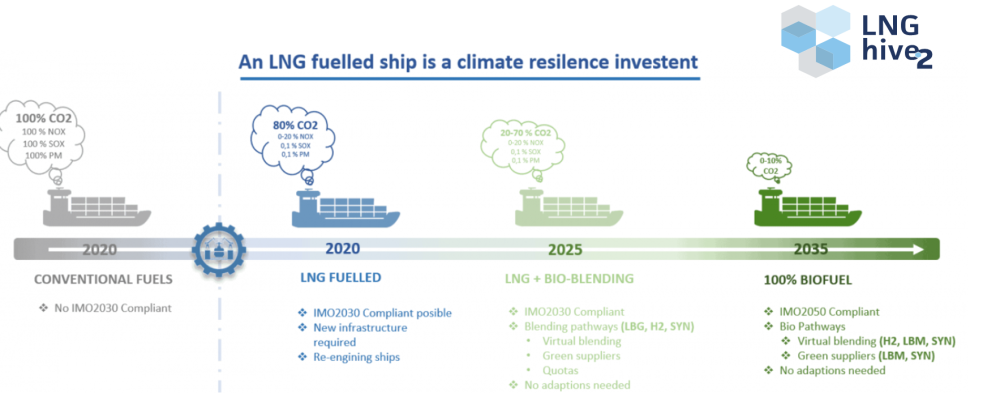

A ship powered by natural gas can directly consume biomethane and synthetic gas mixed in any proportion with LNG, including pure hydrogen in small proportions.

Indirectly, it can also consume any product injected into the gas network that has a system of guarantees of origin.

The Spanish port and gas system are endowed with an infrastructure and regulation that notably favor Spanish competitiveness.

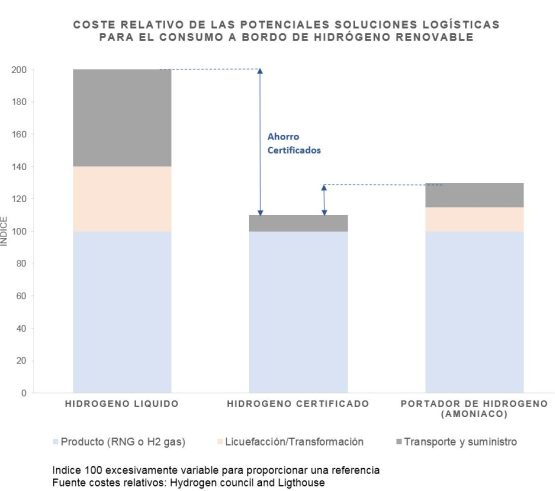

The direct consumption of renewable hydrogen on board ships is very likely to be carried out prior to the generation of an intermediate compound (for example ammonia) capable of increasing the energy density of hydrogen in its pure state and facilitating the logistics of distribution and consumption in transport. maritime, although the development of these fuels is still limited.

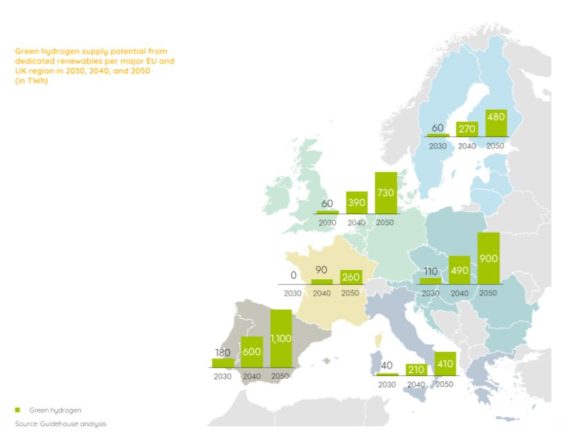

Spain has one of the greatest potentials for renewable electricity generation and an ambitious national hydrogen strategy.

OPS technology is available for large-scale implementation, although this requires adaptation of the fleet in many cases and electrical and civil engineering works to provide the docks with connections suitable for the ships' electrical systems.

Spain has an ambitious national implementation plan as well as the participation of its port authorities in international consortia, currently having connection infrastructure in some ports.

LNG and RENEWABLE GASES (biomethane, H2 and synthetic gas)

The dual-fuel motorization for the consumption of LNG on board and a system of certificates for the different gaseous products of renewable origin that the gas network can integrate, would allow ships powered by natural gas to include renewable gases in their energy consumption directly - limited in the case of H2 - or indirectly - using the certification system - without making additional investments in consumption equipment and infrastructure, but ensuring the possibility to achieve carbon neutrality once industrial production is sufficiently developed.

Spanish competitiveness is valued in relation to the implementation of LNG and renewable gases as marine fuel compared to its main competitors - mainly European, Mediterranean and northern European ports - taking into account 5 fundamental points:

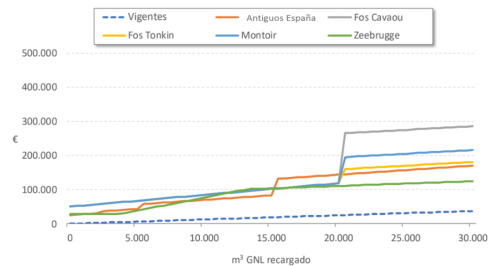

- Availability of LNG logistics infrastructure: preferably with public access to third parties to encourage private sector investment in additional means of distribution -necessary to complete the fuel supply logistics chain-, as well as the integration of renewable products through their injection into the network or marketing in tanks. The main considerations in this regard are included in points 1 and 5.

- The cost of LNG on board: as the main decision factor between ports in the same corridor and sufficient supply capacity. In this regard, there are hardly any cost references for LNG as a marine fuel, although by analyzing the most important cost components (molecule and logistics cost) -see Point 2- it is possible to make an approximation to assess Spain's position.

- LNG bunkering experience: as a demonstration of the ability to integrate a new fuel into the port system with all that this entails in regulatory and investment matters, especially in ship-to-ship supply, the preferred means for shipping companies to carry out their operations.

- Renewable product production potential: The raw material for the production of biogas and synthetic gases is limited and its availability and properties present great variability in the different European countries, so it will be essential to know the national capacity to scale production according to the projections of demand for renewable fuels. .

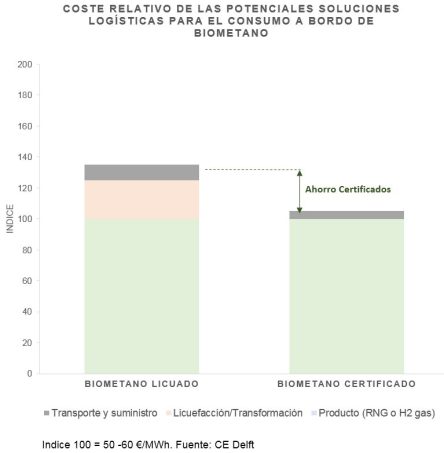

- Logistics chain of the renewable product: logistics substantially determines the economics of the product, and may account for up to 100% of the cost of the molecule, so compatibility for its injection into the network and virtual consumption through guarantees of origin would result in a substantial decrease in the cost of the fuel board

SPAIN IS THE EU COUNTRY WITH THE MOST LNG STORAGE CAPACITY AND ONE OF THE MOST ADVANCED REGULATIONS, MAKING IT POSSIBLE TO AVAIL LNG IN ITS DIFFERENT SUPPLY MODALITIES THROUGHOUT THE PORT SYSTEM

The Spanish gas system (SGN) holds the 25% of European LNG storage capacity, with terminals in both the Atlantic and Mediterranean corridors, which means having LNG available in all Spanish ports at a distance of less than 100 nautical miles. Especially in the Mediterranean Sea this represents a great competitive advantage in relation to competing ports.

All SGN terminals are public access and share a same regulation, unlike many of the terminals in northern Europe and the Mediterranean, where the contracting of services is managed in an opaque manner and access to services can be discriminatory.

Storage capacity is managed jointly (Balance virtual tank) and the service virtual liquefaction It allows exchanging natural gas in a gas pipeline for LNG in a storage terminal. This would enable the renewable natural gas injected at any point in the gas network to be available in the form of LNG without logistical investments.

By last, all SGN LNG terminals have tank loaders and the possibility of recharging LNG ships of almost any capacity.

AT EUROPEAN LEVEL, THE PRICE OF LNG AND ASSOCIATED LOGISTICS SERVICES IN SPAIN DOES NOT REPRESENT A COMPETITIVE REDUCTION WITH RESPECT TO CONVENTIONAL FUELS

The Spanish port system hosts a great deal of conventional bunkering activity, ranking only behind the Netherlands in volume supplied and holding the leadership in the Mediterranean Sea and the Algeciras Strait, one of the main fuel hubs not only at European level but also internationally.

Analyzing the historical price of conventional bunkering in different European ports, it is observed that despite the fact that the Rotterdam area supplies the cheapest marine fuel not only at European level but also internationally, Spain has a strong competitive position in the Mediterranean where the price is the most competitive, improving the price in large fuel hubs such as Singapore.

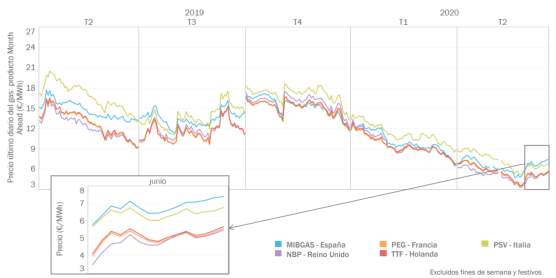

In the case of LNG as a marine fuel, there are no public references to the price served on board, although we can make estimates based on the cost of the molecule and the associated logistics services. Taking STS supplies as an example, accessible to third parties and with public prices in multiple European terminals, the competitiveness of the Spanish port system is summarized in:

Compared to France and the Netherlands the price of LNG as a fuel would be between €0/MWh and €2/MWh, but the cost of recharging would reduce this difference by approximately €/MWh, and could even compensate for the difference in price between hubs.

In the case of conventional bunkering, the price difference is very similar (average €1/MWh), so the use of LNG would not mean a big change in terms of competitiveness..

On the western Mediterranean façade, if the Italian terminals began to offer the recharging service, taking into account the greater number of terminals, the reduced price of logistics services in Spain and the similarity of the MIBGAS and PSV indices, It would seem logical to assume that the final cost of the product would be lower in Spain than in Italy, as is currently the case in the conventional market.

At rest of the competing ports gas markets and LNG logistics services are not sufficiently developed to make an assessment of the potential cost of supply.

THE PORT AND GAS SYSTEM HAVE ONE OF THE MOST EXTENSIVE EXPERIENCES IN THE SUPPLY OF LNG AS MARINE FUEL

The first supply of LNG as marine fuel in Spain was made in 2014 and since then in most of the ports of the Spanish system specific supply operations have been carried out with tank trucks, several of the ports currently accommodate regular supplies, both with tank trucks , as with bunkering vessels and in the near future there will be three ports with dedicated pipeline supply (PTS). To learn more about the distribution and volumes of said supplies in the Spanish port system, you can consult our section on data.

At European level and especially in the Mediterranean Sea, the Spanish port system is one of the main points of supply of LNG STS with regular operations in the ports of Barcelona and Tenerife, and two new supply vessels under construction.

There are currently three supply barges operating in Barcelona, Bahia de Algeciras and Tenerife and one fourth under construction promoted by SCALE GAS. The group ENAGAS, parent company of the SCALE GAS company, is promoting the supply of LNG and renewable gases in the maritime sector, offering new solutions to ensure a cleaner and more sustainable future, increasing its abatement capacity—emission reduction—by promoting operations based on BioLNG.

LNG: GLOBAL SUPPLY ACTIVITY STS

SPAIN HAS GREAT POTENTIAL FOR THE PRODUCTION OF RENEWABLE AND SYNTHETIC GASES THAT CAN BE CONSUMED DIRECTLY OR INDIRECTLY BY MARITIME TRANSPORT. IN ADDITION, SINCE JULY 2021 IT HAS HAD A NATIONAL ROADMAP THAT ENSURES THE COMMITMENT OF THE ADMINISTRATION TO THE DEVELOPMENT OF THIS MARKET

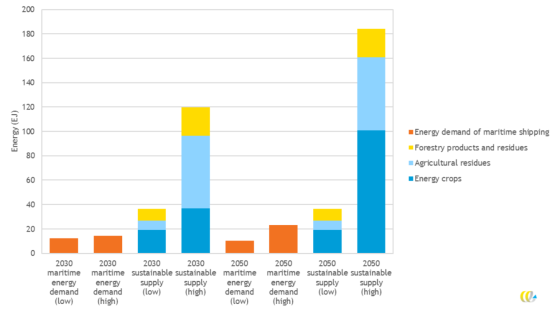

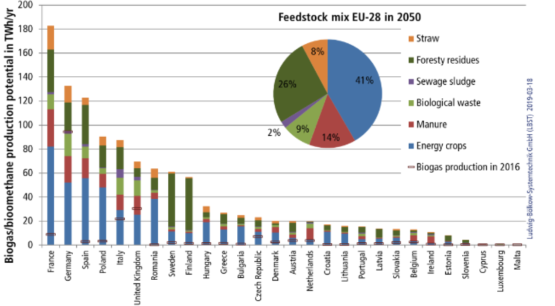

According to the main studies carried out to estimate the European (CE Delft) and Spanish (Sedigas) biomethane production potential there is enough raw material to reach production levels well above European marine fuel demand -estimated at 600 TWh- and Spanish -88 TWh-. Taking as a reference the lower production scenario exposed by CE Delft, the European market would have a supply of approximately 1,100 TWh of biomethane.

To know the current status of the main European and Spanish biomethane production projects, consult the map prepared by EBA-GIE

The Biogas Roadmap complies with the provisions of the National Integrated Energy and Climate Plan 2021-2030 (PNIEC), which allocates its measure 1.8 to the promotion of renewable gases and establishes the commitments and strategies to be adopted by the Spanish administration in favor of the development of the different uses of biogas. Biomethane -refined biogas- receives special consideration in this roadmap for its ability to replace natural gas without substantial modifications in infrastructure or consumption equipment, facilitating its consumption in all types of uses and establishing as a priority the development of production plants - action lines 27 and 28 among others-, as well as the implementation of a system of certificates and guarantees of origin in accordance with European guidelines and regulations -line of action 1-.

It is expected that a total of 5 TWh of biomethane will be produced in Spain in 2030, with projects with a future capacity of 2 TWh already registered, according to data from the GASNAM association, and with the potential to reach up to 120 TWh.

A CERTIFICATION SYSTEM FOR PRODUCTS INJECTED INTO THE GAS NETWORK TOGETHER WITH THE EXTENSIVE NETWORK OF INFRASTRUCTURE AND SERVICES OF THE GAS SYSTEM WOULD ALLOW TO SIGNIFICANTLY REDUCE THE COST OF NEUTRAL MARINE FUELS

The range of LNG logistics services in Spain is one of the most extensive and advanced in Europe. With a system of guarantees of origin and certification of renewable gases and an adequate LNG bunkering infrastructure would allow renewable gases to be marketed in all Spanish ports with minimal logistics cost and without requiring liquefaction and transport equipment for the direct consumption of the renewable product, allowing competition with land uses that consume biomethane or hydrogen in its gaseous form on equal terms..

RENEWABLE HYDROGEN AND DERIVATIVES

AS MARINE FUEL

At a global level, the development of renewable electricity generation is growing exponentially, as well as its costs are being reduced. This increase in supply makes the development of storage solutions inevitable, which allow supply and demand to be matched and allow their use on board means of transport. In addition to batteries whose use in heavy means of transport presents great challenges (weight, recharging, autonomy, cost), Hydrogen production is presented as the most promising large-scale storage solution for excess renewable electricity and its use in non-electrifiable consumption, allowing its consumption on board trucks, buses or ships. Although the low energy density of hydrogen and its cryogenic nature in liquid state (-253ºC) will make it difficult to be directly adopted in long-distance ships, there are alternatives such as transformation into liquids at room temperature with a higher energy density, such as methanol or ammonia (lower efficiency), which could be consumed on board.

Its limited implementation in the maritime field and the reduced production make it difficult to make a comparison at the same level as for renewable gases, although two aspects are identified as key to positioning in this market:

- Renewable generation potential: The availability and reduction of the cost of synthetic fuels is closely linked to an abundant and low-cost renewable electricity supply, so it is expected that in the countries with more resources for renewable production -analyzed in point 1- they will be the largest producers of these fuels.

- Development of the hydrogen value chain: Unlike liquid biofuels or biomethane that take advantage of the value chain of diesel or natural gas, respectively, the use of hydrogen as fuel in transport is very limited and represents an innovation in all areas of the value chain, from production -if it is renewable- to consumption. For this reason, public-private collaboration and the development of comprehensive projects that favor technological development and cost reduction in all areas are essential.

SPAIN IS ONE OF THE EUROPEAN COUNTRIES WITH THE GREATEST POTENTIAL FOR RENEWABLE HYDROGEN GENERATION IN EUROPE

The development of large-scale production of renewable hydrogen is one of the main pillars of the EU's decarbonization strategy by allowing the decarbonization of non-electrifiable uses such as industry and heavy transport. Given the innovative nature of these solutions, neither the technology, nor the regulation, nor the market currently exist for the use of hydrogen in maritime transport. In the long term – between 2035 and 2050 – the expected excess of renewable electricity is expected to favor an environment of low prices and high availability of renewable hydrogen, especially in those countries with the greatest potential for solar and wind generation.

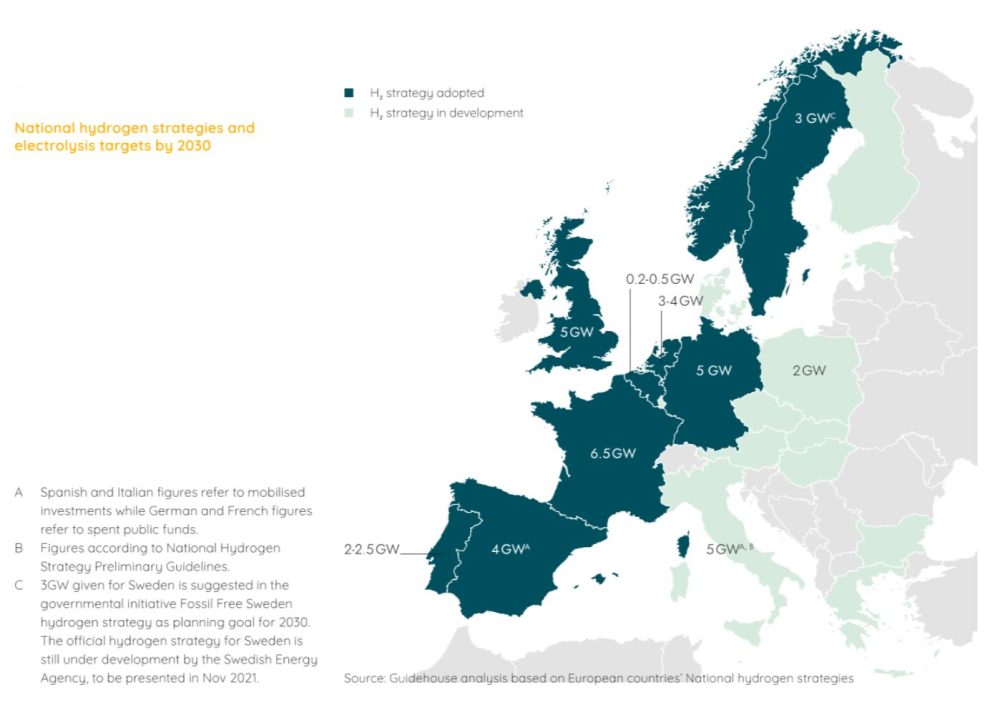

THE SPANISH NATIONAL HYDROGEN STRATEGY IS AMONG THE MOST AMBITIOUS AMONG THE MEMBER STATES, AS WELL AS NUMEROUS NATIONAL PROJECTS IN THE FIELD OF THE HYDROGEN ECONOMY

Most market agents and EU organizations recognize that currently the main barrier to the introduction of synthetic fuels in maritime transport is their limited availability and, therefore, their high price, but there is also concern about the development of the appropriate consumer equipment, fundamentally fuel cells. For this reason, in recent years both the European Union and the member countries have developed hydrogen deployment strategies, fundamentally focused on the development of production and consumption equipment technology, but also multiple public-private initiatives for the development of centers of production.

""Spain leads the way and hosts a third of potential fuel supplies."

T&E 2024

Since June 2024, the T&E organization publishes on its website the E-Fuels Observatory: a summary of clean fuel projects and their supply potential to meet the needs of the European maritime industry. It highlights the leadership of Spanish projects in this area.

ELECTRICITY IN PORT

OPS technology is sufficiently developed for large-scale implementation in most ports, although this requires adaptation of the fleet in many cases and electrical and civil engineering works to provide the docks with connections in accordance with the electrical systems of the ships. In addition, the commercialization of this energy requires the development of new models of electricity purchase and sale in accordance with the electrical regulations of each nation and the specific characteristics of demand, so its use is not yet widespread.

According to the European infrastructure directive for alternative fuels (AFIR), all ports in the CORE network must have OPS connections for passenger ships, cruise ships and container ships before 2030 , being mandatory for ships that call at said ports to connect. This being an obligation at the national level whose speed of implementation will depend on the capacity of said nations to conveniently develop the different necessary aspects (regulation, investments, marketing,...) it is established as a fundamental measure of the positioning of said member country, the availability of high voltage electrical connection points.

Numerous projects are being executed in the Spanish port system, preparing the electrical infrastructure, transformation stations and OPS equipment. Among them stands out the OPS pilot in the BEST container terminal promoted by the Port Authority of Barcelona.

SPAIN HAS A NATIONAL PLAN FOR THE IMPLEMENTATION OF OPS IN ITS PORTS, CURRENTLY EXISTING CONNECTION ALTERNATIVES IN 5 PORTS OF THE PORT SYSTEM