24 Nov 2021

DNV published in September 2021 the fifth update of its Maritime Forecast Report 2050 where the decarbonization scenarios of maritime transport and the technical alternatives for their compliance are analyzed. Lead author Linda Sigrid Hammer shared her thoughts on the steps shipowners should take to develop their green fuel and technology strategies with the magazine Marine Propulsion

Shipping is under enormous pressure from regulators, investors, charterers and society to decarbonise and achieve net zero emissions by 2050. To achieve this tectonic shift, shipowners will have to take practical steps now to transition from conventional marine fuels to carbon neutral and zero carbon fuels. This will mean betting on the commercial availability of future fuels such as green ammonia or green hydrogen, although today they do not exist as marine fuels.

"Shippers face a complex carbon risk landscape"

"Uncertainties are related to the availability of green fuels, but also to the development of technologies to use these fuels and to the evolution of regulations and other factors."

Linda Sigrid Hammer Senior Consultant at DNV, lead author of the report Maritime Forecast to 2050, .

In short, the road to decarbonisation has many twists and turns and is not well lit. The report sets the ambitious goal of distilling a dozen decarbonization scenarios to guide shipowners on potential paths to zero emissions by anticipating the availability, acceptance and price of alternative fuels and green technologies.

The DNV report uses a greenhouse gas (GHG) trajectory model to forecast the fuel mix and CO2 emissions of the global fleet through 2050 under different decarbonisation scenarios.

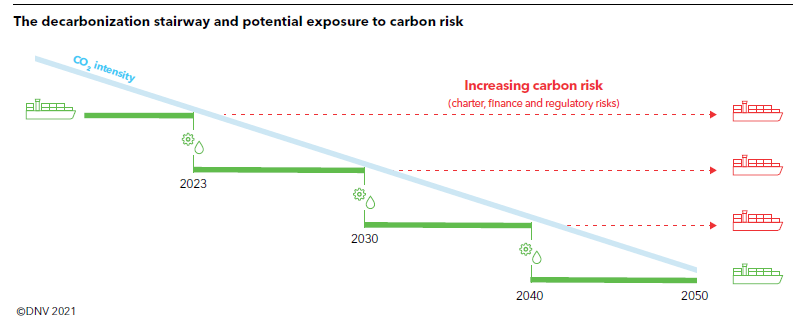

Shipowners will have to identify their own pathway towards decarbonisation. East path "It is a practical plan to stay below the required carbon projection trajectories," says Hammer. And shipowners will need to continually improve the performance of their vessels and invest in them to remain compliant and commercially competitive.

Hammer says this will require taking into account fuel availability and basic measures in the construction phase to "accommodate fuel flexibility... and be prepared for several possible fuel transitions over the life of the ship". This will need to be taken into account in the planning of the 1,000 to 2,000 vessels expected to be ordered annually until 2030.

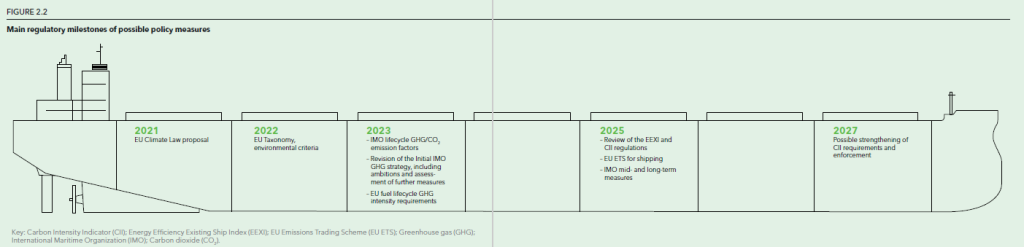

Preparation for EEXI, CII

IMO's greenhouse gas strategy is driving policy development for international shipping, with the Energy Efficiency Index for Existing Ships (EEXI) and Carbon Intensity Indicator (CII) regulations coming into force. effective January 1, 2023. What steps must shipowners now take to assess their current fleet and their future investments in new construction to comply with this regulation?

DNV has developed a three-step approach to this, based on the carbon risk management framework, explains Hammer. "The first step is to identify the baseline, setting the target GHG trajectory over the life of the ship. What is the GHG performance of the ship, or fleet, currently and how should it be?" evolve? The second step is to consider the relevant fuel technologies and strategies to meet the defined carbon reduction trajectory. The third step is to develop an action plan with a defined trajectory. This may involve several fuel transitions and potentially conversions to throughout the life of the ship. This same approach can be applied to existing ships, but the possibilities for conversion are more limited than for new ones." Peak annual investments in onboard technology could reach $60 billion by 2050.

Future prospects for fuel

Hammer says their models suggest a diverse fuel mix heading into 2050, including both fossil fuels and low-carbon fuels, as various fossil fuels are phased out. "There will be room for LNG, LPG, ammonia, hydrogen, methanol and bio- and electric-based versions of these fuels", it states. "And then it is a question of availability of onboard technologies for the use of these fuels. And what we see is that the technologies for ammonia and hydrogen will be available in four or eight years," he adds.

"The combustion engine will continue to be the dominant energy converter in the fleet"

Some shipowners are now choosing to build ammonia-ready ships, which can be converted to burn zero carbon fuel when available. One of them is Höegh Autoliner, which has signed a letter of intent to build a series of multi-fuel ammonia-ready ships. The MAN B&W multi-fuel engine of the Aurora class can run on various biofuels and conventional fuels, including LNG. With minor modifications, you can transition to future zero-carbon fuels, including green ammonia. The first Aurora-class vehicle carrier will be delivered by China Merchants Heavy Industry (Jiangsu) in 2024.

Technologies to run on lower-carbon fossil fuels, such as LNG, LPG and methanol, are now available.

Ms Hammer predicts that "the combustion engine will remain the dominant energy converter in the fleet, but that marine fuel cells will be integrated into power systems as they have the potential to provide greater efficiency and therefore therefore, lower fuel consumption".

The choice of fuel will depend on availability, price, type of vessel and area of operations. Energy density is also a key consideration, Hammer notes, “to maximize the space available for cargo transportation.” Batteries and energy efficiency measures, such as wind power, air lubrication systems and various hull and machinery measures, as well as the development of carbon capture, will also be important.

There is no shortage of obstacles in the energy transition. "As most of these new fuels have different properties, they will pose different safety challenges than conventional fuels. This poses new challenges for the entire maritime industry ecosystem."

Maritime forecast to 2050 | DNV